You can’t read an article about residential real estate without the author mentioning the affordability challenges that today’s buyers face. There’s no doubt homes are less affordable today than they were over the last two years, but that doesn’t mean homes are now unaffordable.

There are three measures used to establish home affordability: home prices, mortgage rates, and wages. Let’s look closely at each of these components.

1. Home Prices

The most recent

Home Price Insights report by

CoreLogic shows home values have increased by 19.1% from last January to this January. That was one reason affordability declined over the past year.

2. Mortgage Rates

While the current

global uncertainty makes it difficult to project mortgage rates, we do know current rates are almost one full percentage point higher than they were last year. According to

Freddie Mac, the average monthly rate for last February was 2.81%. This February it was 3.76%. That increase in the mortgage rate also contributes to homes being less affordable than they were last year.

3. Wages

The one big, positive component in the affordability equation is an increase in American wages. In a recent article by

RealtyTrac, Peter Miller addresses that point:

“Prices are up, but what about wages? ADP reports that job holder incomes increased 5.9% last year but rose 8.0% for those who switched employers. In effect, some of the higher cost to buy a home has been offset by more cash income.”

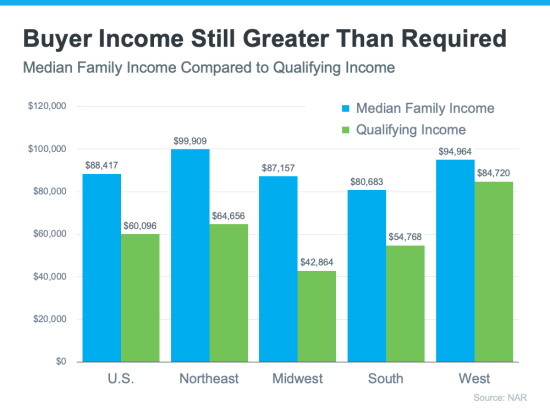

The National Association of Realtors (NAR) also recently released information that looks at income and affordability. The NAR

data provides a comparison of the current median family income versus the qualifying income for a median-priced home in each region of the country. Here’s a graph of their findings:

As the graph shows, the median family income (

shown in blue on the graph) is greater than the qualifying income needed to buy a median-priced home (

shown in green on the graph) in all four regions of the country. While those figures may vary in certain locations within each region, it’s important to note that, in most of the country, homes are still affordable.

So, when you think about affordability, remember that the picture includes more than just

home prices and

mortgage rates. When prices rise and rates rise, it does impact affordability, and experts project both of those things will climb in the months ahead. That’s why it’s less affordable to buy a home than it was over the past two years when prices and rates were lower than they are today. But wages need to be factored into affordability as well. Because wages have been rising, they’re a big reason that, while less affordable, homes are not unaffordable today.

Bottom Line

To find out more about affordability in our local area, let’s discuss where home prices are locally, what’s happening with mortgage rates, and get you in contact with a lender so you can make an informed financial decision. Remember, while less affordable, homes are not unaffordable, which still gives you an opportunity to buy today.